China’s economy has developed rapidly since its evolution from a planned economy, but only recently have consumers built up enough trust in the system to deviate from face-to-face cash transactions that they have relied on for decades. Using credit as a means to purchase goods is a relatively new concept to the Chinese, but its quick adoption has resulted in several benefits, but also unforeseen consequences.

Researchers at the University of Missouri found that credit card adoption in China grew 40% between 2004 and 2009. Despite this astronomic growth, only 30% of urban Chinese households had atleast one credit card in 2012. While the Chinese are realizing the convenience of having a credit card, the government is also encou raging individuals to develop credit histories. In 2015, the government awarded eight companies consumer credit rating licenses in an attempt to develop this new segment of the economy. One such rating agency, Sesame Credit, which is run by Alibaba, offers perks to those who have high credit scores, further incentivizing the use of credit.

raging individuals to develop credit histories. In 2015, the government awarded eight companies consumer credit rating licenses in an attempt to develop this new segment of the economy. One such rating agency, Sesame Credit, which is run by Alibaba, offers perks to those who have high credit scores, further incentivizing the use of credit.

Access to credit has dramatically increased consumption in China, especially with the rise of online-retail. Alibaba, who has developed its own virtual credit card, sees a 50% increase in spending from consumers who spend less than 1,000 yuan ($145) online

a month after they receive the card. While these increased consumption patterns bode well for the Chinese economy, there are also unforeseen consequences.

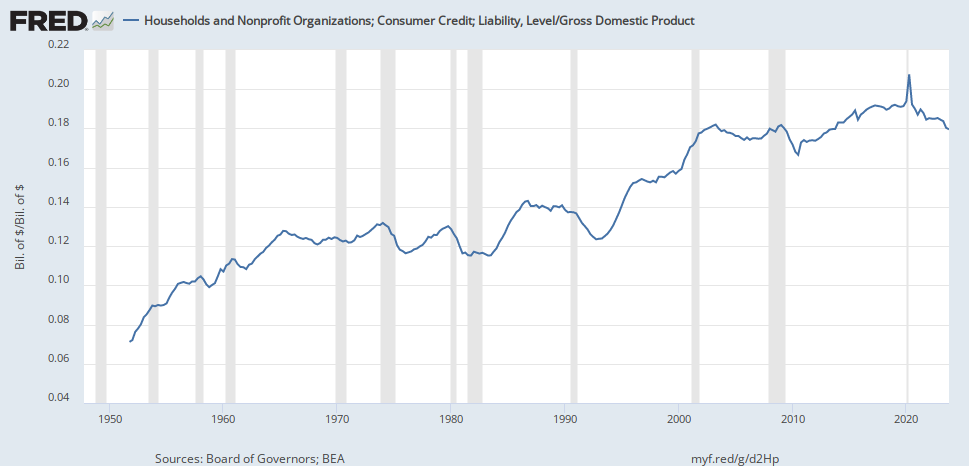

In the first quarter of 2015, Chinese consumers’ credit card debt hit a record high of ~$411 billion, up 35.49% from the first quarter 2014. In tandem with a slowing economy, this figure represented 18.1% of China’s first quarter GDP, compared to 3.8% in the United States. As the use of credit continues to rise, and the economy continues to slow, Chinese regulatory authorities will be forced to implement measures that protect from a potentially catastrophic credit crunch.

In the first quarter of 2015, Chinese consumers’ credit card debt hit a record high of ~$411 billion, up 35.49% from the first quarter 2014. In tandem with a slowing economy, this figure represented 18.1% of China’s first quarter GDP, compared to 3.8% in the United States. As the use of credit continues to rise, and the economy continues to slow, Chinese regulatory authorities will be forced to implement measures that protect from a potentially catastrophic credit crunch.

Sources:

https://www.ft.com/content/e1469cf0-9cf5-11e3-9360-00144feab7de

http://www.vox.com/2015/7/8/8911519/china-stock-market-charts

http://www.tradingeconomics.com/china/consumer-credit

Here are U.S. Data for comparison by The Prof

I think it would be interesting to explore this phenomena through the lens of changing Chinese culture during industrialization. As we saw in Part III of Hessler, Chinese workers are comfortable with lying or intentionally working slowly in order to be paid more or be employed longer. How does this sort of culture translate to usage of credit, and how might it affect defaults going forward?

I think it is interesting to see how the emergence of credit has affected the economy and how credit use has a very heavy hand in economic growth. There seems to be a sweet spot: if there is no debt, or too much, the economy slows, but if the right amount of debt is issued then it can help accelerate and sustain growth. It will be interesting to see if this debt develops into a debt bubble as credit becomes more and more widespread, and what kind of effect that will have on the Chinese economy.

I agree, Peter, there is definitely a sweet spot for the right amount of debt in a certain economy. Right now, though, it seems like the Chinese aren’t able to effectively manage this since there seems to be a credit card craze. We’ll have to keep an eye on default rates to see whether or not Chinese consumers can actually handle these debt levels.

The Chinese Credit market is a very interesting topic and not something we have not really covered in class. While we are seeing a decrease in growth of the Chinese economy, most of this growth was attributed to innovative and robust industrialization. As industrial growth slows and consumer spending rises it will be interesting to observe how these two trends counteract, and if the “sweet spot” mentioned above can be quantified. In reading “The Economist” source provided above, I found it interesting that Alibaba has been encouraging their customers to treat their credit scores as a status symbol, encouraging customers to share their credit scores with friends and even dating sites. I think tying social status is a great strategy for encouraging responsible credit spending in a young and inexperienced consumer base, but I find it simultaneously slightly unsettling.

There are amusing parallels between the way credit cards were first marketed and distributed to US consumers, and the ways you mentioned they are being marketed in China. The focus on the credit score as a status symbol is different from, but not terribly dissimilar to, the way that flashy “keeping up with the Joneses” luxury items were marketed to be associated with credit cards in the US.

It appears that China is interested in getting credit cards more widely adopted as a part of their efforts to boost consumption; we shall see how this and other stimulus efforts play out in the coming years.

I have always found the relationship between increased use of credit (by consumers) and any effect that this spending has on the economy. Indeed, in many cases the use of credit can do wonders for a sluggish spending base. As long as debt is kept under control and a “crunch” is avoided, use of credit cards is a good thing in many cases (it certainly was in the U.S. in the 1960’s).

I would be interested to know more about how young people feel about the use of credit cards in China. I know that the millennial generation in the U.S. has been relatively modest when it comes to racking up debt, although that has been attributed to the overbearing student loan problem that looms over so many. Do Chinese youth think about credit cards as a fun tool, or as outdated and not relevant to their lives?

This post begs the question–will China have the same debt problem the United States has faced. While most of the crippling debt faced by relatively young (30’s to mid 40’s) Americans comes from student loans, credit card spending is certainly a huge part of this. Americans buy things they can’t pay for. Though outside factors where certainly at play, the housing bubble is a clear example of this. China’s economy is so intertwined with the American economy, a debt crisis would have major blow back here in the states. Chinese investment would decrease. We’d likely see the price of imports rise.

On the other hand, Chinese credit could be about striking a fine balance. When the economy moves away from being solely cashed based you can buy more. As a country that only has to worry about the debt when it gets to catastrophic levels, you’ve got to like that. The Chinese are spending more money in different ways, therefore more likely to take part in foreign economies. This rising reliance on credit, for now, seems good, however things could go down hill quickly should debt begin to dominate the Chinese economy.

We saw some of the unforeseen consequences of credit usage during China’s 2015 stock market collapse. As investing on margin (with debt) became increasingly prevalent, normal Chinese consumers who had no experience in the stock market started making speculative bets on the market. The stock market drop that happened as a result of weakening GDP numbers was severely exacerbated by all of these margin trades.

As you said, it will be interesting to see if this increasing reliance on credit has any other repercussions in the near future.

I think only time will tell how Chinese consumers respond to increase credit usage, as it is a relatively new concept for them. Debt will be a concern, but I think a debt bubble will take decades to form. So in the short term, it is more important I feel to study price patterns among consumers using credit cards etc. Long term foundations may be still too early to formulate.

What role does the Central Bank of China play, if any, in this “credit craze”? I won’t lie, I do not know a ton about their People’s Bank of China, and I imagine any information from their website may not tell the whole picture. But, with increasing desire on the part of Chinese migrants to live along the coast in high-cost apartments, the loanable funds market has to play a part in this story, right?

Mason, you make a very interesting point. I tried to do some searching in regards to your loanable funds market question but wasn’t able to find anything of substance. I do know that the Central Bank of China is encouraging the use of credit since they see it as a ways to modernizing. Additionally, this credit profile will contribute to this “social profile” that the Chinese government is trying to implement (see source).

https://www.wsj.com/articles/chinas-new-tool-for-social-control-a-credit-rating-for-everything-1480351590

I do think that someday the Chinese will be more accepting of debt and take on more credit cards. At the moment, technology is so prevalent in everyone’s lives, particularly through WeChat (a messaging app like groupme but incredibly useful and better), there still is not much need for credit cards when they can simply transfer cash like we would using Facebook Cash, SnapCash or Venmo. All goods are rounded up due to the lack of sales tax and all cashier machines accept WeChat (like apple pay) or scan QR codes. I do not doubt that credit cards will become a mainstream staple for the Chinese Consumer but cash still and continues to grow as an integral part of their lives.

1: I think that we should look at consumer credit as a share of GDP, and not just focus on its growth. See the graphs I pasted in with US data. The absolute level of debt is about where we were in 1980, we’re now at 10x that level.

2: One key point we’ve yet to address in class is that in 1984, when reforms began, China had NO banks as we understand them. Zero. So the entire infrastructure of lending against anticipated discretionary cashflow was absent. There was no data on incomes, no data on expenditures, no data on assets, no loan officers of any stripe.

3: Consumer credit is hard to do and labor intensive. If you have very few bankers, they have to concentrate on large loans to large borrowers. There’s also a lot of “infrastructure” in the background, you need a way to track who is whom and develop databases to link names (in the US, social security numbers) to financial data. That takes a decade or so to set up and accumulate enough data to be useful.

4: Consumer credit doesn’t mean that it’s going into consumption. After all, money is fungible, and the marginal change could be greater purchases of stocks and existing real estate, which don’t show up in “C” and thus don’t directly increase GDP or growth.

5: What about Alibaba? People pay using their phones. That’s not credit cards, but it is widely diffused. The US is behind much of the world: we’re only just starting to get the ability to pay for things with our phones.

That is, looking at credit cards may be asking the wrong question!!