Alibaba’s rise to become one of the biggest internet firms in the world has been nothing less than meteoric, a growth trend that is correlated to a degree with the rise of Amazon, a company that Alibaba is frequently compared to. Founded in 1999, Alibaba is a wide ranging conglomerate that provides consumer-to-consumer, business-to-consumer, and business-to-business sales services via web portals. It also provides services in electronic payments, shopping search engines, and data-centric cloud computing. Their E Commerce wing is the strongest section of their conglomerate, with main divisions including Taobao (most popular C2C website in the world), TMall (Alibaba’s B2C platform- competes with Amazon), and their cloud services (second largest in China). As of April 2016, it is the world’s largest retailer surpassing even Walmart with operations in over 190 countries. The numbers speak for themselves in Alibaba’s retail dominance, as they generate more revenue than Amazon/Ebay combined, with online sales/profits surpassing all US retailers (Walmart, Amazon, eBay) combined (Forbes). 80-85% f al E-commerce transactions in China are from Alibaba!

Jack Ma, their CEO, is one of the most respected individuals in China and is credited with fostering entrepreneurial ambitions among the country’s youth. Pursuant of Jack Ma’s philosophy, Alibaba upholds a reputation in consumer friendliness among their products. Reflective of their trust with the Chinese public, Alibaba’s Taobao is considered an intricate part of people’s daily lives, with many consumers trusting Taobao for loans rather than government banks/SOE’s. This trust is seen in the number of users, as Alibaba’s China retail marketplaces boast some 440 million active users shopping the virtual stores of millions of businesses (no other platform comes close in scale). It is because of this positive conception with the Chinese public that allows Alibaba to see major gains during Singles’ Day, a popular Chinese holiday among the younger demographics which celebrates being single. Singles’ Day has become the largest online shopping day in the world, and a way of life. in 2016, Alibaba passed $14B in revenue on Singles’ Day, more than double the $5.8 billion in sales of the combined U.S. e-commerce holidays of Black Friday and Cyber Monday. Similar to Amazon’s popularity with millennials, Alibaba hopes to continue to build their trust with Chinese millennials, a demographic that accounts for 58% of all internet users in a country with the world’s biggest e-commerce market at $672 billion in 2015 (McKinsey & Co.). Their spending power is crucial to many businesses on Alibaba’s platform, and this group will be set to drive future 11.11 spending.

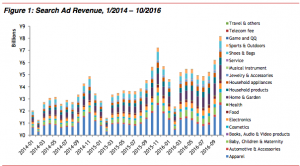

Going forward, the company’s growth projection looks strong based on their recent e-commerce quarter performance driven by 11/11 promotions. Their online marketing services and commission revenues showed better growth Y/Y, and their search advertisement revenue for China retail business is likely to grow 50% Y/Y (32% M/M growth). The Y/Y growth is mainly driven by the growth of click volume, in which the average cost per click was flat Y/Y. Tmall GMV grew 32% Y/Y in October 2016, and high growth will continue partially due to the low base in October 2015 and partially due to the early promotions of 1/11 sales events. With mobility such a crucial aspect of today’s society, Alibaba’s Tmall mobile adoption continues to grow faster. There were 138M incremental downloads of Mobile Taobao and 92M incremental downloads of Mobile Tmall from 1012/2016 to 11/128/2016. The ranking of Taobao’s iOS App went up from 17 in September to 9.8 in October 2016.

Ultimately, Alibaba is guided by a strong CEO that recognizes adaptability methods to changing consumers and society, and is willing to continue to further internet penetration not only in China but also the rest of the world. Ma’s statements for major expansions worldwide echoes the company’s commitment to growth.

Citations:

T.H. Data Flash – Alibaba Group – October 2016

What Everyone Should Know about Alibaba – Quora

Chinese Millennials set to drive 11.11 Spending (Alizila): http://www.alizila.com/chinese-millennials-set-to-drive-11-11-spending/

Alibab’s Singles’ Day: What do we Know About the World’s Biggest Shopping Event. https://www.forbes.com/sites/franklavin/2016/11/06/alibabas-singles-day-what-we-know-about-the-worlds-biggest-shopping-event/#13867a506da7

Despite the success of Alibaba, they still have several obstacles to confront, namely the issue of sales of counterfeit products on its web portals. Though Jack Ma has committed to reducing counterfeit goods for sale, these goods have continued to proliferate and frustrate Western copyright law.

Alden, that is a definitely a concern. I read this in Seeking Alpha this morning for their breakfast report:

Blaming modest penalties and lax laws, Alibaba (NYSE:BABA) founder Jack Ma has called directly on China’s National People’s Congress to ramp up efforts to erase counterfeiting. He even called for the same harsh punishments that are given to drunk drivers. Alibaba was again labeled a “notorious market” last year by the U.S. Office of the Trade Representative – just four years after escaping the label.

How do you policy counterfeits? The sheer quantity of goods and sellers means that Alibaba itself really can’t do it. The only way is for producers to themselves check constantly for counterfeits, and for Alibaba to then have the structure to follow up on complaints.

My daughter has bought fakes on eBay, not necessary knowing what they were, and then turned around and resold them on eBay. She also had one seller from whom she was going buy something get kicked off of eBay, and (having purchased something from that seller) got a warning not to resell anything bought from that seller. It’s a very imperfect process, but eBay is now staffed to follow up quickly. They can’t tell a real from a fake product (though they can spot prices that are too good to be true). Only the real manufacturer can do that.

It’s interesting to notice the wide range of services Alibaba provides, and its success in, what it seems, a largely domestic consumer base. It would be interesting to see if Alibaba will extend into U.S. B2C markets and what kind of impact that would have on US domestic internet companies, such as Amazon. I personally think it would be a difficult transition for Alibaba, due to the lack of rapport with the US market in contrast to the trusts built in the Chinese market.

Alden makes a good point, and it raises a question that I think many Chinese-based companies will want to ask themselves moving forward: are they willing to change their practices to fall in line with Western regulation? One wonders whether entering a broader, global market is worth it (your citation that Alibaba controls 80% of all E-commerce is astounding). Is it worth trying to enter the global market at the cost of some potentially sketchy practices, or will Alibaba remain content with the large market share it has in China. As time moves forward, it will be interesting to see if any company – from within China or from the outside – can compete with Alibaba in the Chinese market.

Alibaba is a really impressive company and have carved out an incredibly strong presence in China. They beat out Amazon in the eCommerce space and are evolving into a giant. I think that Alibaba might be hard pressed to maintain these strong growth numbers though. They have experienced tremendously strong growth thus far but I am a bit skeptical whether this is sustainable and if they will be able to continue to scale effectively. In addition, on Alden’s point, they do also have some problems in terms of the products they offer, but this issue is quickly being addressed.

True conglomerates offering such diverse services are increasingly rare in the United States today, as the most successful conglomerates like Johnson & Johnson have largely gobbled up the lesser competition. To see a company like this storm onto the scene in this way in China is fascinating, but I too would be skeptical of their electric growth numbers maintaining themselves for much longer.

Given the fact that the SEC cannot audit them, I wonder if we will ever know if they are legitimate.

Alibaba is widely praised for it’s success as the premier e-commerce company in the world but they are still under-rated in at least one sector of their capital investment. Alibaba’s cloud computing division is rapidly catching up with Amazon’s and they will soon be competing on the international stage for the most high profile business clients. We take American blue-blood companies like google and Amazon for granted; it’s very possible that large firms like Alibaba could be powering the internet and cloud-computing infrastructures of large American businesses soon in the future.

Regarding Alibaba’s Western expansion and brand recognition, it is important to note Taobao. While many Chinese seek loans from Taobao instead of seeking investment from formal banks and SOEs, such loans could be instrumental in expanding Alibaba’s business. Perhaps Alibaba may best be suited to tap into the Silicon Valley market and thus continue to expand their Western efforts.

Tap into? Do you mean lend to?

As we are starting to discuss in class, China has an “immature” financial system. That provides room for unusual business models such as that of Taobao.

It would be interesting to see Alibaba try and compete with Amazon. As stated above, Alibaba certainly has some issues complying to a more westernized standard of business obeying copyright laws, but competition in the way of large, all purpose online retailer in earnest would produce interesting results as well as greatly broaden the market. Would this contribute further to the death of brick and mortar stores? Would one have to specialize? Would this open up more avenues for financial fraud from overseas? It’s truly hard to predict.

While Alibaba is an impressive company that has risen to prominence around the globe, I think that they have a couple issues that they must tackle going forward. Firstly, as people have already talked about, Alibaba must tighten restrictions on selling fake goods across their platforms. These fake goods are being inspected more closely by western regulatory offices and a decrease in this revenue stream would definitely take a hit on the company. Additionally, Jack Ma and his team must figure out a way to convince the American public of Alibaba’s worth as a publicly traded company. Due to the shady nature of many Chinese businesses, it seems that westerners are hesitant to invest in the company. As seen from its top shareholders, Softbank, Yahoo, Jack Ma, and Joseph Tsai (Exec. Vice Chairman) own ~60% of the shares outstanding. If you look at the top shareholders of many large-cap American stocks, they are mutual funds — we will have to see if Alibaba is able to strengthen its image despite the poor reputation of many Chinese businesses.

I think Alibaba is a great investment, especially in the mid-term. Analysts predict huge growth over the next couple of years at the very least. I know that many managers have been and are adding Alibaba to portfolios in the states, which signals that investors are at least treating them like the real deal. Markets don’t seem to be bothered by the “shady nature” of Chinese companies.

1: What is Alibaba’s business model? or rather core business models? Unlike Amazon, they had to make money from the get-go, there were no outside investors, no IPO, no banks. Furthermore, there’s still comparatively little online advertising in China; that’s not a feasible source of core revenue for Chinese internet companies. So how did they / do they make money?

2: Unless Alibaba brings a different business model, the barrier to entry in the US is very high due to the large investment (billions of dollars) Amazon has made in fulfillment centers, and the vendors / supply chains tied to those. That gives it a huge cost advantage over anyone using a similar model.

This is very interesting. I was studying at a Chinese university during Singles Day 2015 and our professors actually asked the class if anyone had bought anything. It reminds me of an online version of the American Black Friday, a promotion event which has now expanded to become a fundamental part of Chinese youth culture. In my mind, Alibaba is one of the first private Chinese firms to develop the sort of cultural and social influence we in American have come to expect from firms like Coca Cola, Walmart, and Google.