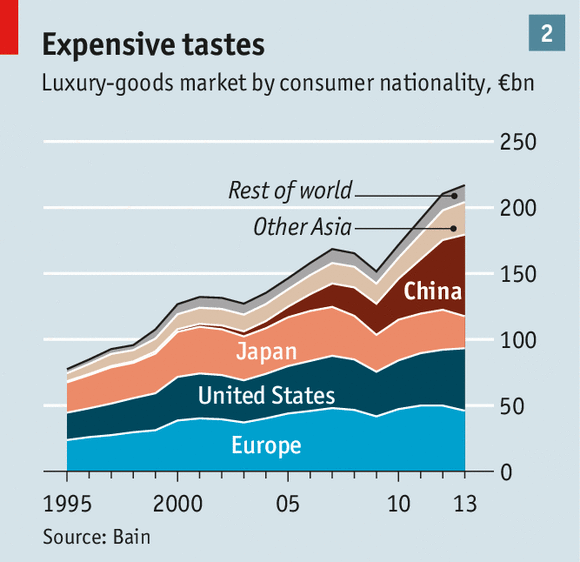

As Austin Miller wrote in his previous post, Xi Jinping’s anti-corruption campaign is having a stark effect on luxury purveyors in China: in fact, “a leading cognac brand has seen sales fall by 30%,” sales of shark fin dropped 70% in 2013, and imports of Swiss watches were down 24% in the first quarter. But despite a contraction in sales to Japanese and European shoppers in 2013, the global luxury-goods market grew to almost USD 300 billion (RMB 1.8 trillion). Chinese consumers make up 29% of this consumption, and though 20% of their purchases were made in Europe, (home to 1/3rd of all luxury good sales), sales on China’s mainland still grew last year by 2% (down from 7% in 2012) despite both the negative growth in Japan and Europe and Xi’s crackdown on excess.

Moreover, as Andrew Shipp mentioned in his last blog post, competition is rising for foreign firms in the consumer goods sector. This is partially due to a clampdown on the part of the central government, but more of the effect can be attributed to Chinese consumers no longer being willing to pay a large markup for foreign branding as domestic produce increases in quality. This is occurring in tandem with China’s shift to a more service-based economy (as opposed to an industrial one, evidenced by the contraction in China’s manufacturing index) and can be taken as an indicator of economic development. Luxury brands, too, are feeling the squeeze: according to a report from the Economist, “the low-hanging fruit is gone.” Foreign luxury brands are more-and-more merging local culture and branding with their luxury image—Hermès launched Shang Xia in 2010, inspired by local crafts, BMW will produce Zhinuo brand luxury vehicles, and Mercedes will sell Denza-branded models.

China is also leading the world in the ecommerce market, which domestic firms have been better at adapting to—another factor explaining the decline in foreign firms’ market share. China is also the biggest producer and consumer of smartphones, and will soon lead the world in the mobile commerce market. More than 2/3rds of Chinese consumers read product reviews online, compared to just 40% in the US. But if foreign consumer goods firms are bad at adapting to the online and mobile marketplaces, foreign luxury firms are even worse: according to the Economist’s report, “luxury websites take four times as long to load in China as elsewhere (because most firms do not put servers inside China’s Great Firewall, which slows access to foreign sites) and rarely offer yuan prices or purchasing options. Mobile commerce is growing in China, but few luxury firms’ websites are optimised for mobile devices.” Changing tastes and marketplaces may soon displace foreign luxury companies in the same way that they are displacing foreign consumer goods firms.

All this means that Chinese consumers are becoming more sophisticated, and in fact in many ways are already more so than the Western consumer. Foreign firms in both the consumer goods and luxury sectors will have to quickly adapt to both an internet-based marketplace and to changing–more indigenous–preferences in China’s growing middle class if they wish to survive in the more competitive market. It also goes to show that, despite a slowdown for some luxury brands under Xi Jinping’s newly austere administration, the outlook for high-end retail in China is good: according to Bruno Lannes of Bain & Co., “the Chinese have become, and will remain for a long time, the most important luxury consumers.”

Further reading from the Economist: China loses its allure, Less party time, Doing it their way, Beyond bling

So do Chinese have an unusual taste for status? Is the fixation on cigarette brands we see in Country Driving somehow unique (though we in the US focus on something other than cigarettes)?

So is this really a country that is more internet-savvy than ours, or that some status goods in China are different from those here, leading to differential success across purveyors of “luxury”?

I think that China really is more internet-savvy than us. It is Asia, after all, that pioneered the writing of “mobile novels,” and the statistics about consumer behavior do not lie. As far as status goods, traditionally they have been those produced in the West (Rolex, BMW, Hermès, Gucci), but as preferences change and foreign firms fail to adapt to changing markets, locally-branded goods will take off. I believe China does have an unusual taste for status goods, evidenced by the much higher percentage of income spent on cars compared to similar countries (it is not being spent on more cars, but nicer cars) as detailed in Dunne’s American Wheels, Chinese Roads.

[…] contributors to this blog have mentioned before Xi Jinping’s expansive anti-corruption campaign (myself, Miller, Helvey, and Brister). China Daily reports that Guangdong official Wang Kewei has become […]