An official on China’s monetary policy committee expressed fear that the Federal Reserve’s policy of quantitative easing will lead to higher inflation, diminishing the value of China’s American holdings. At present, China has $3.3 trillion in U.S. long-term securities.

There has been some concern on the part of FOMC members about the Fed’s policy. Those who disagree with continuing the policy warn of inflation, claiming quantitative easing may expose the economy to greater risk.

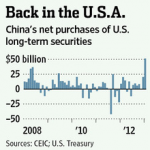

Despite the Chinese official’s concern, China added $51.3 billion, a record amount, to its foreign-exchange reserves in January. China made the second largest purchase, $36.9 billion, in May 2008, pre-crisis.

Is the January purchase a sign of renewed economic stability?

(Source: WSJ)

The world is awash with savings … the “rebalancing” issue. The US absorbs a lot – that includes Chinese purchases of our assets matched by Chinese trade surpluses. But the flows are leading to unsustainable increases in debt (in the US, though sustainability is a matter of a decade time frame) and irrational increases of low-return assets that have only downside risk (for Chinese, any rise in US interest rates leads to capital losses – since interest rates can’t fall further there’s no potential for capital gains – as does any appreciation of the RMB).

The other aspect (which I probably won’t get to in today’s class) is that the People’s Bank of China purchases these dollars from exporters with RMB. That makes for liquidity (low interest rates) inside China, fine if the economy is growing slowly, but otherwise not.

There’s no sign of inflation building in the US – despite lots of fear-mongering by right-wing “monetarist” hacks [who can’t be bothered to read what Milton Friedman actually wrote as an economist] and gold-bugs [for the faithful, that inflation is just around the corner is a belief held with all the fervor of a religious cult]. However, in China the story is otherwise: inflation is a chronic problem (as is true of developing countries in general, including Japan in the 1950s and 1960s). One issue is that the service share of the economy is growing, and service costs are tied closely to wage rates since productivity doesn’t shift much [the efficiency of cutting hair doesn’t improve, and since growth brings congestion, the efficiency of taxis and buses actually falls]. That raises the CPI (and leads over time to a shift in the relative cost of goods [cheaper!] relative to services). However, China is also poor, and so food prices matter a lot. Boosts in income lead to demand for higher-value-added foods that can shift faster than supply (and such foods also include lots of labor as the demand for processed food rises faster than for [say] flour or rice). We may look at data today (Wed 27 Mar) on that. But our underlying issue will be the challenge that China faces as a developing country in improving financial markets and implementing monetary policy.

This is an interesting conflict between China and the US. China is complaining about our currency manipulation through our third round of QE, but the US has been continually complaining that the Chinese have been keeping the yuan artificially low for unfair trade advantages. With the federal funds rate virtually zero, quantitate easing is one fo the only options that the fed can use to spur more lending and investments.

I’ve been working on a mock FOMC paper for Money and Banking, and agree with Prof Smitka that inflation should not be a short term concern. Monthly inflation rates have been below the post-WWII historical average since 2009, even with the Fed’s unprecedented expanisonary monetary policy. Inflation may come into the picture eventually (last month did see the largest spike in CPI in about 4 years), but there are more important things to worry about right now.