As recent numbers have indicated, China’s economic growth is slowing down from its boom days of the 1990’s. With the 1997 Asian financial crisis and 2008 global credit crisis behind us for the most part, the next question on everyone’s mind is what will drive growth in the future? In China’s case, its established manufacturing and service industries, which experienced rapid growth since economic reforms in 1979, are exactly that, established. Transition to a more sustained slow-growth model is now on the horizon, mirroring the United States exiting the industrial revolution. The next question is how China intends to maintain stability through its transition. I believe it will be through a series of mergers, and the loosening of FDI restrictions. This strategy was employed in the domestic aviation market, which experienced massive growth between 1980 and 2002. However, with the introduction of competition through unrestricted firm entry in 1993 the market continued to grow but efficiency did not. This resulted in a net loss across the industry in 1998, never seen before in the history of the country’s civil aviation program. The Chinese regulatory body, CAAC, authorized a series of mergers in which the three major and most established in terms of volume and financial health acquired a multitude of smaller firms. These large firms had matured, growing at a rate of 7% per annum, relative to smaller carriers growing at an average rate of 126% per annum. However, these smaller firms were not able to achieve economies of scale and maximized efficiency. A total of 41 carriers merged with the three major carriers.

A similar phenomenon occurred in the US during the 1980’s and 90’s during which there were a large number of mergers across all industries. I believe china will experience similar in the coming years, supporting growth and growing efficiency within the economy.

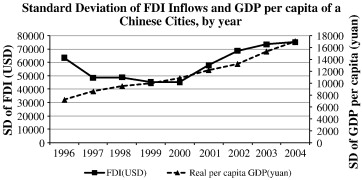

Currently, China is experiencing a series of input decreases, which drove growth in the 1990’s. Labor supply is diminishing, urbanization is occurring at a lesser rate, the incremental capital output ratio is increasing, and risks are developing in financial and real estate investments. Fixed investment grew to 49% of GDP in 2011, thus when capital output ratios increase investment will fall. Since investment is bound to decrease in China in the future, how will China continue to compete at the level it has in the past? What sustainability does Chinese industry have without foreign direct investment?

source: http://www.ft.com/intl/cms/s/0/e854f8a8-9aed-11e2-97ad-00144feabdc0.html#axzz2PQGeYBh1

So this is a prelude to putting in place a hub-and-spoke system? Or is it simply an unwinding of the crazy-quilt patchwork of provinicial state-owned enterprises, the numbers (41) seem the right order of magnitude to reflect a shift of that sort.

With respect to the aviation case, the unwinding of provincial state-owned enterprises increased both industry revenue and efficiency within the market. In 1998, 3 years before the major mergers occurred due to a relaxation of regulation, industry revenues grew around 12%, but experienced a loss overall. This was the first negative year in the sector since economic reform in 1978. My question regarding China’s lower-growth model is this: Is China currently in a position in which it can efficiently (profitably) operate at lower growth rates, or is an unwinding of provincial state-owned enterprises necessary to achieve long-run sustainable growth?