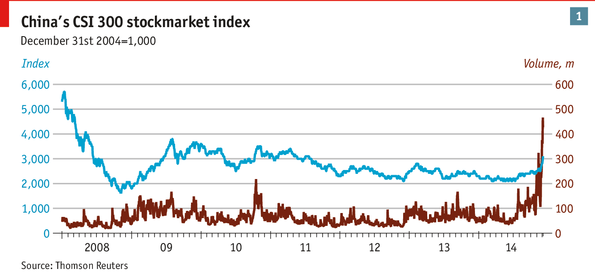

Shanghai’s stock market has not been known for its strength in equities in the past. However, in the last two weeks Chinese stocks have experienced extremely large gains, the market as a whole has gone up 21% according to The Economist. This recent surge has pushed China’s stock market value to $4.5 trillion, now making it the second largest in the world. This a great refresher from the poor performance Chinese stocks have been experiencing since the global financial crisis.

This bull market is pushing a lot of retail investors into the market. Unlike the United States or many other developed countries, retail investors are the largest portion of the Chinese stock market accounting for 80% of the trading that happens in China. In just the past week over 370,000 new brokerage accounts had been opened in China, the highest number in three years. A good amount of this surge in prices is due to speculation by retail investors who are seeking to reap short term gains in the usually shady and unprofitable Chinese equities market.

It is unclear if China will be able to maintain this momentum. Many of China’s trading multiples are indicating that this gain in prices may have just been overdue and China’s financial system may have finally caught up to the rest of the country’s economic development. The average price to earnings is 35% lower than its 10 year average according to an analyst at Morgan Stanley despite this recent price increase. Even if the fundamentals are present to support an bull market in China, a good portion of the recent gains are likely due to an influx of investors speculating.

The one month progress of the Shanghai Stock Exchange Composite Index from Bloomberg.

The one month progress of the Shanghai Stock Exchange Composite Index from Bloomberg.

Sources:

If it’s “momentum” then we know the answer: trends don’t continue. The description does suggest (i) a speculative surge, particularly the large number of new players, but as you note (ii) P/E ratios provide support. My understanding is that payout ratios of Chinese firms are very poor, though, reflected in high corporate savings (retained earnings) rather than distributions to shareholders. So for a rational investor high profits won’t necessarily make buying a firm’s stock attractive, unless there is a pending policy shift that will force firms to pay out more.

To touch on a wider theme, paying out more would be good policy, contributing however modestly to “rebalancing”. It won’t change profits vs wages, but it will mean that the propensity to turn profits into GDP [via consumption] may improve a smidgeon.

Blogs ou should be reading

[…]Here is a Great Blog You Might Find Interesting that we Encourage You[…]…