In an interview with Bloomberg News, John Saunders, an employee of Blackrock MD and Head of the Asian Real Estate department, claimed that even though the continual decrease in the real estate market is slowing, it has still not bottomed out yet. He furthered his assertion, saying that China still has a while to go before they can consider their market stabilized. This past January, real estate prices fell in 69 major cities, focusing in the residential sections. In the 3 different tiers of the Chinese residential sector, tier 1 has stabilized, and the lesser two tiers both fell, with the 3 having drastic drops. Saunders asserts that banks are refusing to give out loans and the lack of liquidity is a major cause of these issues. All these issues together, Saunders believes that the real estate market still requires at least 18 months until a major improvement can be expected.

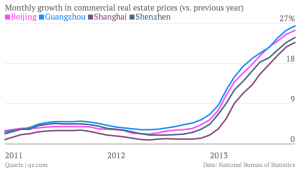

On the other hand, in a New York Times article by Reuters, he claims the opposite. Reuters recognizes that the real estate market is still decreasing by at continually marginal levels. The January decrease was the smallest that the real estate has experienced in 2 decades. In fact in cities like Beijing and Shanghai real estate prices have been on the rise for years.

Additionally he explains that the stabilization in tier 1 makes sense due to the centralization of wealth and then the poorer tiers have decreased because they are the last to recover. Finally he states that new mortgage loans have actually increased, but not too fast as to avoid inflation.

Additionally he explains that the stabilization in tier 1 makes sense due to the centralization of wealth and then the poorer tiers have decreased because they are the last to recover. Finally he states that new mortgage loans have actually increased, but not too fast as to avoid inflation.

Reuters’s argument may be supported with superior evidence, but one point remains necessary for improvement: government stimulus. With continual government aid, the poorer tiers can rise and the entire economy can be stabilized.

Sources:

http://www.macrobusiness.com.au/wp-content/uploads/2014/02/monthly-growth-in-commercial-real-estate-prices-vs-previous-year-beijing-guangzhou-shanghai-shenzhen_chartbuilder.png

http://www.bloomberg.com/news/videos/2015-02-17/china-property-recovery-may-be-18-months-away-saunders

In Japan, the US and the EU recent housing downturns will all take / have taken a decade or more. In the US, for example, housing began declining in 2006, so we’re now in the 9th year, with prices below peak and construction levels far below normal (pre-peak) levels. So lots of people remain underwater on their mortgages, or nearly so.

Why should China be different? — a recovery in 18 months? One reason might be minimal leverage, as many houses are purchased with cash or with mortgages that are only a modest portion of the total. Still, a price drop means lots of wealth vanishes, and the wealth that remains is illiquid. There may also be lots of indirect leverage, people borrowing through other channels than direct mortgages, while the number of units still owned by developers who are debt financed may be very large.

=======

Prose: “still not bottomed out yet”?! — “not (yet) bottomed” suffices. Also you make it sound as though Reuters is also citing Saunders, which is unlikely as he would be arguing the exact opposite…