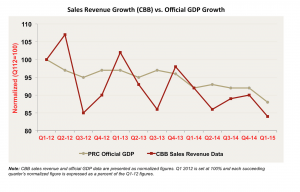

Last week Chinese economists released their quarterly growth statistics for Q-3. The 6.9% overall growth was the nation’s slowest expansion since the financial crisis of 2009. While Chinese premier Li Keqiang did not comment on the economy missing the forecasted 7%, the weakening of steel consumption and energy use during the quarter indicate the a weakening of heavy industry and manufacturing, two of the primary drivers of the country’s growth. Most mainstream news sources in the United States published the Chinese national growth data; however, there is often scrutiny of the data the country releases.

The China Beige Book, directed by the leadership of Washington and Lee University alum Leland Miller, is the world’s leading data analytics firm focused specifically on the Chinese marketplace (chinabeigebook.com). “Founded in 2010, China Beige Book International operates its own independent in-country private data network, led by hundreds of on-the-ground researchers that provide real-time economic data and customized survey work for both corporate and financial sector clientele, as well as over a dozen of the world’s largest central banks” (chinabeigebook.com). China Beige book finds its business in a market niche of skeptical investors. It is not uncommon to find articles citing the inaccuracy of the economic data the Chinese government releases. Over the past twelve months China’s central government has cut interest rates six times, and during the collapse of the country’s stock market in June 2015 the Chinese government worked to correct the market by “pumped billions of dollars by buying stocks directly or though various government controlled entities, banning IPOs and secondaries to limit supply of new stock, banning short-selling” (forbes.com).

Chinese author Gordon Chang expressed significant skepticism of the 6.9% economic growth released by the country in Q3. Chang “contends that official economic data does not give a picture of 7 percent growth, pointing to indicators including rail freight (down 10.1 percent in the first two quarters), trade volume (down 6.9 percent), construction starts by area (down 15.8 percent), and electricity (up by just 1.3 percent)” (thediplomat.com). Yukon Huang, senior associate at the Carnegie Endowment’s Asia Program, similarly stated his doubts on the economy’s growth data, citing that “half of GDP is growth determined by investment, half by consumption” (thediplomat.com).

Leland Miller and the China Beige Book team pursue the goal of providing accurate economic data to the global marketplace, using “country-wide, independently-collected data on real-time growth, employment, wage, and inflation and a uniquely granular window into the country’s historically opaque credit environment” (chinabeigebook.com). The publication of this accurate data can help investors make more informed financial decisions when undertaking foreign investments or are analyzing the equities market, which is proven to have significant ties to Chinese business growth. The interpretation of accurate statistics will be important for analysis of the twenty first century’s greatest growth story.

The beige book seems to be not only useful for statistics but also for potentially keeping China’s published numbers in check. When will the beige book publish its numbers for Q3 growth, and how do you think they will compare to the “official” numbers? Also, what benefits does China see in publishing numbers that many know to be false? The beige book should consider making its presence known to Chinese commoners.

I’m curious as well to see what the Beige Book publishes for Q3 growth. Sanford Bernstein, in an article I read in a Chinese news site (VOANews) claimed the real number was closer to 4.1%. Do either this figure or the reported figure of 6.9% raise any alarm bells for the Chinese economy?

Have any of these articles referenced how low growth rates may reach in the coming years? There are clear downward trends in recent years regarding much of China’s economy, and I wonder where experts think it will finally plateau.

How does the beige book bypass the strict information restrictions that China puts in place on all data exiting the country? It was illegal to report air quality until a few years ago and it’s still illegal to post statistics regarding certain industry data and other environmental statistics. Doing so without passing it by the Chinese government usually leads to imprisonment and deportment. Are they all just private contractors who keep a low profile?

Having attended Mr. Miller’s presentation at Washington and Lee last year (and having heard him give a talk to my East Asian Politics class), I am fairly certain that CBB receives their information directly from Chinese firms. As far as I can remember, Mr. Miller specified that members of his company have established personal relationships with executives from hundreds of firms in a variety of industries all across China. These contacts allegedly feed their information directly to China Beige Book, however he never really touched on the legality of this practice.

Mr. Miller hopes to Skype our class; we’re trying to find a date that works.

The CBB interacts with government officials, who also appreciate getting an outside perspective that contains structured qualitative information – that after all is what the “Beige Book” put together by each of the 12 regional Federal Reserve Banks in the US does. While they’re careful to not keep an office in Beijing to limit government leverage, they’re not working against the government. But they make money by selling their basic report, which is not publicly available. (They also make money from “bespoke” research and reports.)