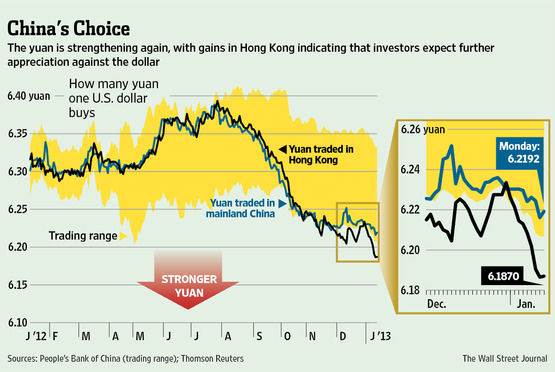

China’s central bank controls international exchange rates on the global market. On Monday the bank set a record daily rate of 6.2695 RMB/USD, the highest [target] rate since May 2nd. With the RMB/USD rate allowed to fluctuate up to 1% during the trading day, intraday trading hit the highest level since the introduction of China’s modern currency exchange system in 1994. China is likely to continue strengthening of its currency to reduce import prices amidst inflation concerns; consumer prices rose 2.5% in December. Internationally, an appreciating yuan could attract more investors as it holds forth possible capital gains on asset prices. Additionally, it would improve political relations by reducing the country’s trade surplus, which the US and Europe argue gives exporters an advantage due. While investors believe that any appreciation of the Yuan will be modest compared to gains in 2010 and 2011, many are bullish on the next 3-6 months. Source: WSJ

China’s central bank controls international exchange rates on the global market. On Monday the bank set a record daily rate of 6.2695 RMB/USD, the highest [target] rate since May 2nd. With the RMB/USD rate allowed to fluctuate up to 1% during the trading day, intraday trading hit the highest level since the introduction of China’s modern currency exchange system in 1994. China is likely to continue strengthening of its currency to reduce import prices amidst inflation concerns; consumer prices rose 2.5% in December. Internationally, an appreciating yuan could attract more investors as it holds forth possible capital gains on asset prices. Additionally, it would improve political relations by reducing the country’s trade surplus, which the US and Europe argue gives exporters an advantage due. While investors believe that any appreciation of the Yuan will be modest compared to gains in 2010 and 2011, many are bullish on the next 3-6 months. Source: WSJ

You note the impact of exchange rates on trade and direct (and portfolio) investment. But what about the perspective of domestic savers / investors? Are their portfolios very diversified? Don’t they face an incentive to increase their holdings of foreign assets? We can’t automatically presume that capital controls are holding the yuan at an artificially low rate!

Also, look at the BIS trade-weighted exchange rate estimates. The US is not China’s only trading partner; if the yuan is appreciating relative to the dollar and the dollar relative to the euro and Japanese yen, then the impact can be much greater than you suggest.

It has also been the policy of the US government to devalue against all trading partners, not just China. A sustainable path to prosperity is not driven by devaluations unfortunately which is why the impact of this currency war will be crushing in the end.

Ah, but will the weaker US dollar lead to a “currency war” (and with whom)? How in fact can we [the US] affect the value of the dollar? Do we have any tools to actually do that, given that the major exchange rates all “float”? Low interest rates, yes, but everyone else has low interest rates, too, so we can’t change the interest rate differential — it’s 0% pa vs 0% pa vs 0% pa in the US, the EU and Japan.