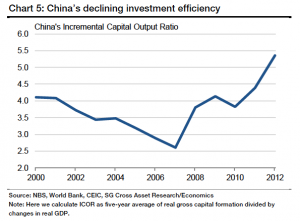

Today, premier Li announced the new strategies to stimulate the economy including accelerating railway construction, building housing for the poor, and cutting taxes for small businesses. According to an article in the Quartz, “railway and public housing aren’t going to fix China’s economy.” The main question that arises from this new agenda is “who will foot the bill.” The private sector debt is currently 200% of its GDP and debt further increases risk. Finding a “sustainable means of finance” is the next challenge for the Chinese government. Still, are these projects going to generate value and help boost the Chinese economy? Is premier Li attempting to pull another “government spending trick” to revert the current downward trend of the economy?

Today, premier Li announced the new strategies to stimulate the economy including accelerating railway construction, building housing for the poor, and cutting taxes for small businesses. According to an article in the Quartz, “railway and public housing aren’t going to fix China’s economy.” The main question that arises from this new agenda is “who will foot the bill.” The private sector debt is currently 200% of its GDP and debt further increases risk. Finding a “sustainable means of finance” is the next challenge for the Chinese government. Still, are these projects going to generate value and help boost the Chinese economy? Is premier Li attempting to pull another “government spending trick” to revert the current downward trend of the economy?

Aside from the increase in employment from these projects, the infrastructure that is being constructed will be an effective catalyst for future economic growth.