Alibaba is newsworthy. It’s not just the size of its IPO; it’s that (relative to Amazon) it has a business model that generates profits. Does that mean that buying the newly listed shares is sensible? The (Financial Times) FTAlphaville blog as the following graphy on the complex structure of the company. They also link to the SEC filing, headed by several infographics. If you’ve never looked at a prospectus – I can’t think why you would have! – then scroll through to get a sense of what information a company provides. Page 20, for example, has a consolidated finance summary; in their fiscal year (ending Mar 31, 2014) they earned (EBITDA) $5 billion.

How does that compare with other companies? Ford – admittedly with lower growth potential, but nevertheless growing – had EBITDA earnings of $11.5 billion; that gave them a market capitalization [share price x # shares] of $63.6 billion or 5.5x EBITDA. In addition, Ford pays a dividend of (at the current share price) 2.9%. So what sort of earnings growth and payout would BABA (the trading symbol) need to justify their $223 billion market value? Using 6:1, they’d need to earn $37 billion – and pay some of that out to shareholders. China’s a big market, and Alibaba is growing quickly, but…

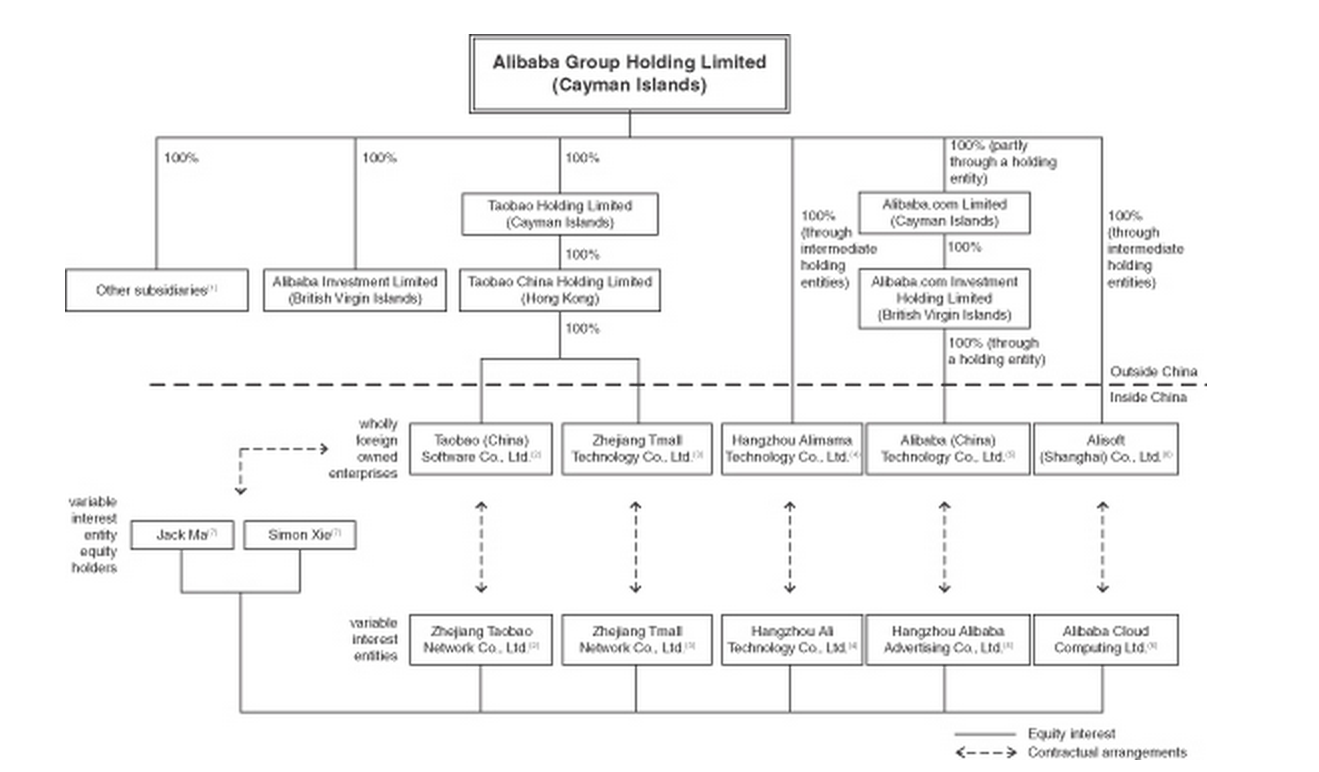

Back to the graph: this is their corporate structure. Should this let a potential investor feel confident that they know where profits come from and whether a portion of such profits might eventually find their way to shareholders?

To be honest, I had expected to find a more byzantine structure that included minority shareholdings by various outside investment vehicles of the various subsidiaries. This is actually a straightforward holding company structure – except for those outside contractual relations.

I am curious how Alibaba’s stock will fare. It is currently trading around $90, yet Jack Ma has stated his primary focus is Alibaba’s customers and employees, not the stockholders. We will certainly see fluctuations but is there potential for long term growth with it?