Pirelli, an Italian tire maker, is the latest Italian business to be acquired by a Chinese company. On March 22nd China National Chemical Corporation (CNCC), a state-owned conglomerate, agreed with Pirelli’s controlling shareholders to buy Camfin, a holding company which owns 26% of the tire maker. This is a first step before launching a takeover bid for the whole group. In total CNCC will be paying €7 billion for the whole business, making it the largest Chinese investment in Italy so far.

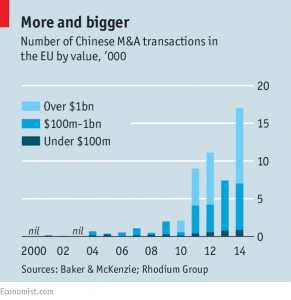

China’s investments in Italy have been growing rapidly from almost nothing in 2008 to €6 billion last year. This not only makes China Italy’s largest source of foreign investment, but it also makes Italy the biggest beneficiary in Europe of Chinese investment after Britain. Chinese deals in Europe as a whole rose from $2 billion in 2010 to $18 billion in 2014. Chinese firms are following an edict to acquire advanced technology and high-quality brands from abroad that the government laid down in its five-year plan of 2011. Until recently most outbound dealmaking was by state firms buying up raw materials. Now high value-added businesses are the main target, and private capital is flowing: in 2014 private Chinese firms accounted for 41% of deal value.

Europe’s difficult financial situation and the declining euro facilitate China’s access into the European market. Unlike the US, where the government is more selective about who it allows ownership of strategic assets, Europe’s thirst for foreign investments make it much more accepting of Chinese investments. Additionally, Chinese companies are slowly learning how to manage European businesses, giving them independence and facilitating their access into the Chinese market.

In my opinion this deal is beneficial both to Europe and China. China, has more savings than it knows what to do with and Europe is in desperate need for cash. These transactions may be considered risky for all participants: if it had other choices, Europe would not trust China with control of many of its strategic assets. Similarly, China does like the idea of operating under another nations laws. However, both countries can see that growth can best be achieved together.

Source: http://www.economist.com/news/business/21647331-more-european-businesses-are-coming-under-chinese-ownership-gone-shopping

Thoughtful analysis. The weak Euro certainly leads Chinese firms, who operate under a de facto dollar exchange standard, to think “now” rather than later. That there is a concentration in Italy may be random, or may reflect the geography of European integration, which left Italian firms with a more domestic focus than others (cf. Michelin for tires) and hence in a weaker position given the relative performance of the Italian economy. So low share prices and a weak Euro!

Whether this is good for China depends on how the investment does relative to buying US$ bonds. If the Euro gets stronger, good. If Pirelli’s performance improves, good. If both, great (given low yields on US Treasuries). However, those “ifs” can’t be taken for granted. Firms that are easy to purchase are often ones who know they’re in trouble and want to find deep pockets before that becomes obvious to one and all…

I should add that there are precedents for tires. Yokohama Tire bought Mohawk. Bridgestone bought Firestone. I’m pretty sure Continental has bought at least one other maker. There are likely other deals of which I’m unaware. (Does Hankuk have factories in the US? Europe?) There are also directly operated foreign subsidiaries, such as that of Michelin in Greenville SC, and likely many others.