According to Asian Development Bank, following three decades of exceptional economic growth, the People’s Republic of China (PRC) is now regarded as an upper middle-income country. With its economic growth, China, along with Ireland and the United States, drove growth in the in both the world’s bank and non-bank finance industry.

According to Financial Stability Board, last year, a sector topped USD 80 trillion in assets. Global shadow banking, or lending not captured on banks’ balance sheets and therefore slightly regulated, grew by USD 1.6 trillion in 2014. Due to its short history and experience in the economic world, China is worried by many that it will bear lots of shadow banking risks, which are shifted from the United States.

There has been lots of problem in China’s banking system as well. The newish government of President Xi Jinping vowed to push ahead with financial liberalization. On March11th 2014, regulators approved a pilot scheme to allow five privately owned banks to be set up in various parts of the country. Along with its rapid growth, China’s banking sector also bears high-level corruption scandals. Yang Kun, former vice president of state-owned Agriculture Bank of China Limited (HK 1288), may soon be prosecuted for allegedly taking bribes from Beijing-based property firm Blue Harbor Properties Co. Ltd. For the development of Solana- a shopping center in a large park near Beijing’s central business district. According to Caixin, a well-respected financial media outlet, Yang accepted “tens of millions of yuan” from the developer in return for extending about 3 billion yuan (USD 480 million) of loans to the company since he became vice president of ABC, China’s third largest lender by assets, in 2004. Yang had worked at ABC for 29 years.

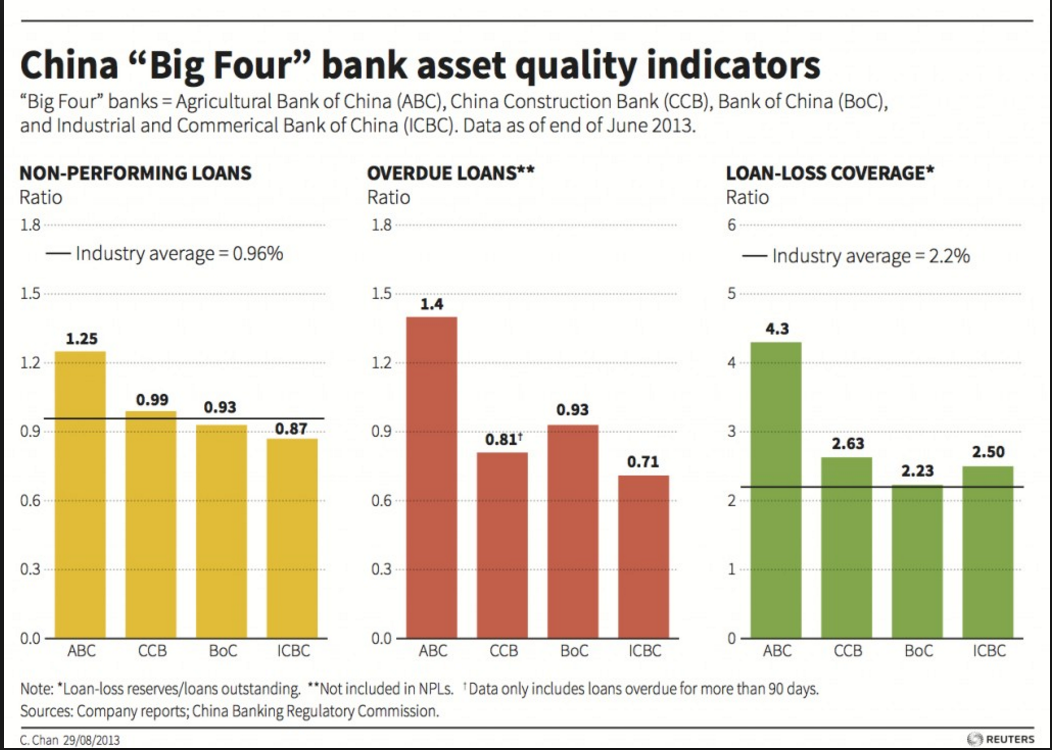

He is the highest-ranking bank executive to be investigated since the “Big Four”state-owned banks listed on the market.(China’s “big four” are: ABC, Bank of China, China Construction Bank Corporation, and Industrial and Commercial Bank of China).

Yang is definitely not a unique case of corruption of China’s banking system. Other cases would be Zhou Caikang, the former head of a regional branch of China’s central bank; Tao Liming, the president of Postal Savings Bank of China, the country’s seven-largest bank; Zhang Enzhao, the former head of China Construction Bank.

Fraudulent loans are on the rise in China as economic growth slows, threatening to further undermine the country’s $29tn banking system, which is already under pressure from an indebted corporate sector. China remains the largest exporter of illicit money, with over a trillion dollars flowing illegally out of the country from 2002-2011. And the Bank of China allegations have been called by many as “money laundering”. Bad marketing and flawed investment products rocking the reputations of Chinese banks have now spread to the world’s biggest lender by assets.

Along with its rapid growth, China, as the largest economic body over the world, has caught the eyes of many economists. Many points out that Chinese financial system need to be improved. And Barry Eichengreen argues that developing the Chinese financial system starts with reforming and strengthening the banks. Methods like commercialization, regulatory rationalization, and widening the regulatory perimeter are highly crucial to Chinese banks.

Work cited:

“People’s Republic of China and ADB”, Asian Development Bank, Web. 25. Feb. 2016. http://www.adb.org/countries/prc/main

Don Weinland, “Shadow banking risks shift from US towards China”, South China Morning post, 13. Nov. 2015. Web. 27. Feb. 2016. http://www.scmp.com/business/banking-finance/article/1878617/shadow-banking-risks-shift-us-towards-china-fsb-report-says

“China’s banking: March of the Banks ”, The Economist, 15. Mar. 2014. Web. 2. Mar. 2016. http://www.economist.com/news/finance-and-economics/21599049-financial-liberalisation-moves-ahead-china-march-banks

Moran Zhang, “A look At China’s High-Level Corruption Scandals In The Banking Sector”, International Business Times, 21. Mar. 2013. Web. 2. Mar. 2016. http://www.ibtimes.com/look-chinas-high-level-corruption-scandals-banking-sector-1141369

Don Weinland, “Chinese bank hit by USD 4.9bn loan fraud”, The Financial Times LTD, 17. Feb. 2016. Web. 1. Mar. 2016. http://www.ft.com/cms/s/0/31fd750e-d06d-11e5-831d-09f7778e7377.html#axzz41nN4ONtG

Michele Fletcher, “China’s Underground Bank”, Global Financial Integrity, 16. July. 2014, Web. 1. Mar. 2016. http://www.gfintegrity.org/chinas-underground-bank/

Don Weinland, “World’s biggest bank gets caught up in China investment scandal”, South China Morning Post, 1. Dec. 2015. Web. 2. Mar. 2016. http://www.scmp.com/business/banking-finance/article/1885510/worlds-biggest-bank-gets-caught-china-investment-scandal

Barry Eichengreen, “China’s challenge- how to strengthen the financial system”, Capital Ideas, 26. Aug. 2015. Web. 2. Mar. 2016. http://chicagobooth.edu/capideas/magazine/fall-2015/chinas-challenge-how-to-strengthen-the-financial-system

What is “financial repression”? and what does that imply about the benefits of access to official bank loans?

After doing some investigation into financial repression, my understanding is that it holds interest rates at a sub-zero level, encouraging investment in the government. The Financial Times Lexicon notes “the combined effect of all these measures means funds are channeled to the government that would otherwise flow elsewhere.” This effectively buys up government debt, and in turn has negative effects on Chinese households.

As Nicholas Lardy of the Peterson Institute for International Economics explains, “Financial repression costs Chinese households about 255 billion renminbi (US$36 billion), 4.1 percent of China’s GDP, and a fifth of it goes to corporations, one-quarter to banks, and the government assumes the rest.” The effects of this are not in line with the government’s goals, however. If China wants to truly move away from an export economy and towards domestic consumption, the government must tackle financial repression. Chinese households have less income as a result of it, which in turn negatively affects their spending; think – if households had not lost US$36 billion to the effects of financial repression, they would have been able to use at least some of it to stimulate the economy through spending.

http://lexicon.ft.com/Term?term=financial-repression

https://www.piie.com/publications/interstitial.cfm?ResearchID=999

It’s encouraging to hear that the Chinese government is beginning to accept the reality of privately-owned banks. Although the American financial system has aptly demonstrated that private banks are not immune to corrupt activities, I think private banks can bring some much-needed clarity to the Chinese financial system.

Beyond clarity, I think private banks can better cater to individual consumers and small businesses. The state-owned banks have shown favoritism to large state-owned corporations, and as a result, capital has been hard to come by for small businesses and individuals. As the Chinese economy develops, a new dynamic will be the emergence of mortgages, as has been the case in the United States. These privately-held banks must be the suppliers to this emerging market where state-owned banks have failed to provide.

I’m not convinced that changing ownership is really substantive, because the evidence on the link between formal governance structures and firm performance is very weak. Whether privately owned or not, banks remain subject to pressure from local governments.

And they face the business logic that stems from financial repression. As long as interest rates remain artificially low and bank staff short on experience, China’s banking system will remain biased in favor of large lenders. Switching ownerships changes neither of these constraints.

When I was doing research on this topic at the beginning of the year, I read about a handful of international business deals such as the Sino-Forest Corporation where Chinese companies were inflating their reported earnings. Chinese companies are often influenced by their personal relationship with the Chinese government. Patterns like this in both the private and public sector affect all aspects of China’s modern economy including the banking system and, therefore, affect more than just China, but the international markets it touches as well.

Relationship banking is standard everywhere – indeed, the more competitive banks are in their lending terms, the more that cultivating relations is what lets you book loans.

Of course having “books” that can be trusted, more or less, is important. Just as China had no bankers 30 years ago, so too they had no accountants, no accounting guidelines, zip. So providing certified accounts is a challenge because a lot of the industry still doesn’t really know what they’re doing, and even if they do, management is not attuned to the importance. In an economy growing 10% per annum on average and 20% in income-elastic sectors, it was hard to devote your attention to accurately protraying where your business was during the previous fiscal year – the Wenzhou model mindset might not be that universal, but you’re already moving on to some new line of business, and thinking about what would come next after that matures a year or two hence!!