An early topic this term will be foreign exchange rates. After all, we need/want to be able to compare China to other countries, and to understand trade and international finance issues. So here’s a bit of perspective. We also need to develop the concept of “PPP” (purchasing power parity).

For more on this topic, see “China’s Awkward Exchange Rate Regime” by Cecchetti & Schoenholtz (Kim was a grad school classmate who chose Wall Street over academics).

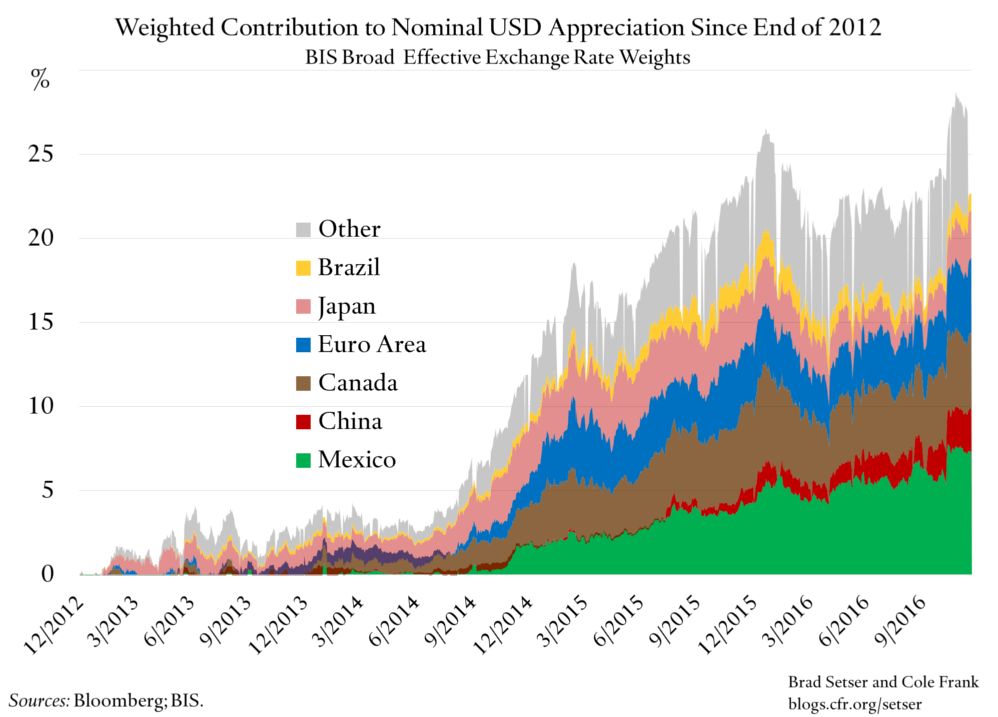

To the above let me add a graph pulled from a post by Menzie Chinn (Econbrowser) which he in turn pulled from a November 2016 post by Brad Setser of the Council on Foreign Relations, China’s October Reserve Sales, And A New Reserves Puzzle. The key here is the drawdown on foreign reserves, the (mainly) US dollar balances China accumulated over the past 2 decades. Think: what should selling dollars [to buy RMB, China’s currency] do to the price (foreign exchange rate) of the RMB? Does this imply that China is deliberately pushing down the value of its currency?

![]()

The Chinese purchase of RMB should put upward pressure on the value of the currency. Given the increase of the spot exchange rate between USD and RMB, dollar appreciation may be the real cause of the decline in the RMB’s value.

A good set of questions, we’ll put it into an S&D framework to make sure we remain consistent. For example, here if the RMB sets stronger, the converse is the dollar gets weaker (depreciates). So that part of your comment is a tautology. You do have one piece of a causal mechanism; there are more, demand coming from government purchases. The rest of you think about other sources of S and D!

China’s drawdown on foreign reserves is an unsustainable policy. The Chinese reserves of USD are not infinite, and they will eventually have to change tactics. With the dawn of President-elect Trump’s regime, it will be interesting to see how the Chinese respond, if at all, to his claims that they are “currency manipulators.”

So what happens to the value of the RMB if they stop using their reserves to sell dollars to holders of RMB? The Chinese who buy dollars then presumably deposit them initially into an account in the US, either because they want to hold non-Chinese assets or they need to pay for imports.

One aspect of the linked article I found particularly interesting was the use of credit issuance to promote and stimulate economic growth. This could hurt the Chinese economy in a couple of ways. When that debt begins to be paid off, the debt service payments will be made to the issuer instead of being injected into the economy. If the debt goes bad and become nonperforming this would also have a negative effect on the economy. Another point I found interesting was the fact that the Chinese government is actively trying to appreciate their currency rather than depreciate it despite President Trump’s comments. I think that this makes sense as the Chinese economy continues to transition from a production based economy to a consumer based economy. A consumer based economy doesn’t thrive with a depreciated currency in the same way that a production based economy does based on the fact that there is less reliance in international exports.

It’s interesting to see the Bilateral exchange rate of the Yuan/USD increase indicating depreciation, while the ReeR has increased since 2014 indicating an appreciation of the Yuan worldwide. This draws a lot of questions about the state of the Chinese economy especially since China is such a large trading partner with the US. It’s also apparent, however, that the Chinese economy is on the downward slope after reading James T. Areddy’s article in the WSJ which highlighted the increase in investments in Chinese insurance companies that were actively looking towards foreign expansion and investment, as opposed to bonds from the Chinese Central Bank. http://www.wsj.com/articles/in-china-insurers-sell-risky-products-to-fund-risky-investments-freaking-out-regulators-1484130601. It is also alarming to notice the depreciation of the Yuan compared to the USD, because this could mark decreased Chinese investment in US markets and increased US spending on Chinese exports. This would contribute to a contraction in the US economy in the future based on the IS/LM Model.

At present, China has a fixed exchange rate. The People’s Bank intervenes to prevent the Yuan’s depreciation against the currency of “a country that is in a stronger phase of its business cycle” (i.e. the US dollar). China is the world’s largest economy and has about $3.2 trillion in foreign exchange reserves. The RMB has depreciated versus the dollar by more than 11% in the past couple of years. An unstable boom in real estate prices is occurring, and the country may need to allow the RMB to float, which could allow the economy to absorb shocks that drive reserves sharply up or down. However, in order to maintain depreciation against its East Asian trading partners, so as to allow domestic goods to remain appealing on the open market, the RMB needs to sustain its depreciation against the USD. To answer the prompt: selling dollars would cause the RMB to strengthen against the dollar, making domestic goods less appealing to China’s trading partners. It is difficult to astutely answer whether or not China should continue to allow its currency to depreciate against the dollar in the face of globalization, but the article states that allowing the RMB to freely float is China’s best policy option moving forward. Without radical institutional change, the problems facing China’s exchange rate regime are merely delayed to face its consequences at a later date.