We will continue developing our segment on exchange rates and comparisons. In the background are foreign exchange rates. We will return to the issue of why hold forex (introduced to hang in the background). Our quick discussion pointed to the following motives/needs:

2. investment: adding Chinese assets to a portfolio of stocks and bonds

• for portfolio diversification

4. [foreign] direct investment, to build a factory or develop a business in China

In class though we began by looking at market exchange rates, which are highly volatile (the yuan has moved 0.5% against the dollar since yesterday). China isn’t suddenly producing 0.5% less than yesterday; the average resident isn’t poorer, either. So that’s an awkward metric. In any case, in Jan 2014 one US$ bought RMB6.04, now it fetches 6.88, or about 15% more. That of course makes it harder for firms to export to China, and makes imports from China less expensive.

But that’s a bilateral metric, while China is part of the wider global economy. In terms of trade Europe is more important to them than the US. [future blog post topic: present data on the geographical composition of China’s trade] So we want to look at a trade-weighted measure (and without delving into details, one corrected for inflation in each country). Once we do that, we see that the dollar has gotten stronger over the past 3 years, so even with the depreciation of the yuan against the dollar, the RMB is about 15% stronger than it was in 2014.

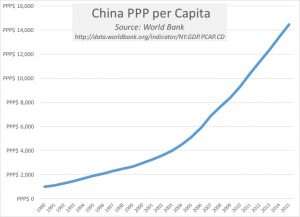

That still doesn’t address the issue of volatility. It’s also a measure driven by finance and traded items, but we don’t consume money, and (untraded) services are more important than goods. So our next topic is “Purchasing Power Parity” metrics.